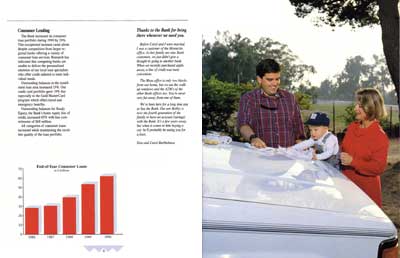

Consumer Lending

The Bank increased its consumer loan portfolio during 1990 by 29%. This exceptional increase came about despite competition4om larger regional banks offering, a, variety of consumer loan services. Research has indicated that competing banks are unable to deliver the personalized attention of our local loan specialists who offer credit tailored to meet individual needs.

Outstanding balances in the installment loan area increased 13%. Our credit card portfolio grew 19% due especially to the Gold MasterCard program which offers travel and emergency benefits.

Outstanding balances for Ready Equity, the Bank's home equity line of credit, increased 65% with line commitments of $68 million.

All categories of consumer loans increased while maintaining the excellent quality of the loan portfolio.

Thanks to the Bank for being there whenever we need you.

Before Carol and I were married, I was a customer of the Montecito office. As herfamily are also Bank customers, wejust didn't give a thought to going to another bank When we recently purchased appliances, a line of credit was most convenient.

The Mesa office is only two blocks from our home, but we use the walkUP windows and the ATM's of the other Bank offices too. You're never very far away from one of them.

We've been here for a long time and so has the Bank. Our son Robby is now the fourth generation of the family to have an account (savings) with the Bank It's a few years away, but when it comes to him buying a car, he'll probably be seeing you for a loan.

Don and Carol Barthelmess

|